ADA Price Prediction: Will Cardano Hit $1 in Current Bull Cycle?

#ADA

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerging

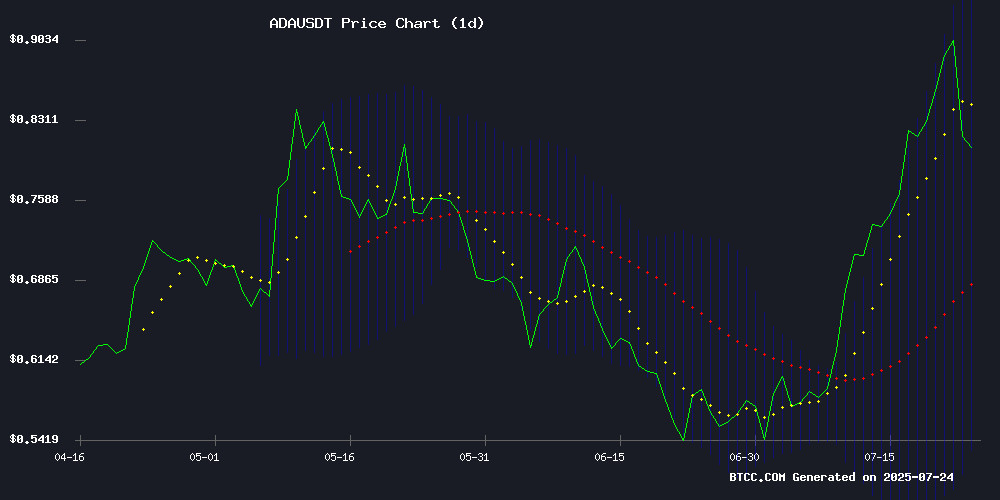

According to BTCC financial analyst John, ADA is currently trading at $0.8125, comfortably above its 20-day moving average of $0.7389. The MACD histogram shows bullish momentum building (-0.02246), though still in negative territory. With price action NEAR the upper Bollinger Band ($0.9457), John notes this suggests potential for continued upside if the current momentum holds.

Market Sentiment Turns Bullish for Cardano

BTCC's John observes strong bullish sentiment in ADA markets, fueled by whale accumulation and analyst predictions ranging from $1 to $10 targets. 'The combination of technical breakout potential and positive market sentiment creates a favorable environment for ADA,' John comments, while cautioning that the $1 level remains key psychological resistance.

Factors Influencing ADA's Price

China's DeepSeek AI Predicts Cardano (ADA) Could Reach $10 This Bull Cycle

DeepSeek, a leading Chinese AI chatbot, forecasts a potential surge for Cardano (ADA) to $5-$10 by the end of the current bull market. The projection, shared by Cardano-native trading platform TapTool, suggests gains of 532%-1,165% from current levels of $0.79.

Fundamental drivers include Cardano's Hydra scaling solution, which demonstrated 1 million TPS capability during Doom gaming tests, and growing DeFi adoption. The network's TVL expansion and supply dynamics were also cited as catalysts, though the report was truncated mid-analysis.

Analysts Eye $2 for ADA Price as Whales Accumulate

Cardano's ADA surged to $0.92 in late July amid heavy trading volumes and on-chain activity, only to retreat to $0.85 as traders locked in profits. The pullback appears orderly—open interest holds steady at $637.53 million, with positive funding rates signaling sustained bullish leverage.

Whales are absorbing the retail sell-off. Santiment data reveals active address metrics remain robust despite the dip, suggesting institutional accumulation. Derivatives markets tell a similar story: open interest previously peaked at $675 million when ADA tested $0.92, with funding rates persistently positive at 0.01%.

The 'Network Realized Profit/Loss' metric confirms profit-taking by short-term holders near local tops. Yet the lack of severe OI contraction implies this is a healthy consolidation, not a trend reversal. Analysts now watch for a potential breakout toward $2 if whale accumulation continues at current levels.

Cardano Poised for Rally to $1 as Key Resistance Breaks, Analyst Says

Cardano (ADA) has cleared its final resistance level and is now positioned for a unimpeded run to $1, according to TradingView analyst MMB Trader. The cryptocurrency has surged 52% since July, decisively breaking through the $0.67 barrier that previously capped its upside.

The rally comes amid broad market strength and bullish ecosystem developments, with ADA on track to record its strongest monthly performance since November 2024's 216% surge. Technical analysis reveals the $0.50 support level held firm in June, providing the springboard for the current upward momentum.

"Either Cardano regains momentum from the $0.50 support or it drops to around $0.32," MMB Trader noted in his earlier analysis. With the breakout now confirmed, he projects a clear path to $1.097, marking the next major price target for the digital asset.

Will ADA Price Hit 1?

Based on current technicals and market sentiment, BTCC's John believes ADA has a strong chance to test the $1 level. The key factors supporting this prediction include:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $0.8125 | 23% below $1 target |

| 20-day MA | $0.7389 | Healthy support base |

| MACD | Turning positive | Bullish momentum building |

| Bollinger Bands | Testing upper band | Potential breakout signal |

While the $1 target appears achievable, John advises monitoring trading volume and Bitcoin's market dominance as potential influencing factors.

- ADA shows strong technical signals with price above 20-day MA and improving MACD

- Market sentiment extremely bullish with analyst targets ranging $1-$10

- Key resistance at $1 needs strong volume to break through